Cryptocurrencies are both intriguing and perplexing. However, cryptocurrency mining is one step ahead when it comes to making people scratch their heads. This page explains everything you need to know about bitcoin mining and related terms.

Crypto comes from the Greek term kruptos, which means hidden. As some level of technical expertise is required to enter the crypto realm, it remains hidden from the general public. So let’s take a deep dive into the world of cryptography to unveil its nuances.

What exactly is cryptocurrency?

Cryptocurrency is presently valued at USD 45,597 per coin, down from USD 63,557 per coin on April 14, 2021. According to Statista, there were 5,840 cryptocurrencies as of August 2021. Popular cryptocurrencies include Bitcoin, Ethereum, Cardano, Tether, Binance Coin, XRP, etc. On CoinMarketCap, you can view a comprehensive list of information such as their market capitalization, current price, etc.

As a matter of convenience, I will sometimes use Bitcoin to refer to cryptocurrencies in general and bitcoin to refer to the currency itself. Bitcoins are digital currency managed on blockchains, which are decentralized digital ledgers. They circulate (are mined) and are utilized without the oversight of any public or private agency. It is similar to the people’s money. It is up to regular people like us to make it a reality.

Blockchain, its underlying technology, ensures its secure operation. Similarly, this technique underpins non-fungible tokens. Blockchain is a digital database that maintains an immutable and permanent record of all transactions. Moreover, blockchain verifies transactions by network consensus. Nodes perform this validation procedure to validate ongoing transactions. Additionally, this activity generates fresh bitcoins for circulation.

Interestingly, unlike traditional currency, most cryptocurrencies have a circulation restriction. Only 21 million Bitcoins may be mined, for example. This characteristic makes cryptocurrencies an effective hedge against inflation. Public conjecture is the sole thing that can affect the value of a digital coin. It can plummet due to a sell-off or rise if people are clamoring to utilize it.

Currently, cryptocurrencies are utilized more as an investment opportunity than as a currency, but they are maturing as more and more sites accept them. From Microsoft, Paypal, and Overstock to Burger King, more and more people are paying with these online currencies, so it’s time for you to master them.

Taking one at a time, let’s dive right into the article’s crux, cryptocurrency mining.

What is cryptocurrency mining?

Numerous cryptocurrencies exist, and their mining processes vary significantly; therefore, we will focus on bitcoin, and this section will elaborate on bitcoin mining in particular.

Crypto mining generates new currency and verifies ongoing transactions using encryption to prevent counterfeiting and double-spending. To comprehend mining, we must first comprehend how blockchain operates.

Suppose you are purchasing tableware from Overstock using bitcoin. Simple, just add the item to your cart and check out using bitcoin as the chosen payment option. Your transaction is added to the next block after being placed in the verification queue along with other entries awaiting verification. Each block is currently limited to 1 MB of data.

The miner receives a reward for the formation of a block and verification of the transactions within. After all, they spend their resources (read: electricity, equipment, etc.) to solve complex math problems in order to add your transaction to the blockchain. This “difficult math problem” involves locating a hash, a 64-digit hexadecimal value.

The incentive is typically paid in the cryptocurrency itself, but not every miner receives payment; only the first miner to generate the right hash is compensated; the rest receive nothing except a power bill. Therefore, the method is dangerous, occasionally fruitful, and time-consuming if you lack access to sophisticated computational resources.

Now that we have a general understanding of the crypto mining process, it is time to reveal the underlying technical specifics.

The core of blockchain security is hash, which comes first.

What is Cryptocurrency Hash?

As stated previously, you must find the hash to finish a block of transactions. A hash looks like this:

00000000000000000004b79b7874718f022311e5194547644b119d30220ca18fEvery block is connected with a unique hash. It is always 64 digits, regardless of the transaction data. Any modification of a single transaction will yield a different hash; hence, once recorded, transactions are tamper-resistant. In addition, each block’s hash is tied to the hash of its prior block, which contributes to the blockchain’s immutability. Because any attempt to modify a single block would alter the hashes of all following blocks, this will eventually result in a fork, a separate blockchain beginning at the point of the modification.

Depending on the length of the chain, this procedure can need a great deal of computer power and be so time-consuming (and expensive) that it can be rendered futile. There are a few system-generated forks, which can be viewed as upgrades. For example, the London Hard Fork on the Ethereum was legitimate. It occurred on August 5, 2021, at 12:33:00 UTC, from block 12,965,000. You can view the history of all forks on the Ethereum blockchain here. This secure method of protecting blockchain transactions with hashes is known as cryptography.

How do miners locate the target hash?

The target hash is a numeric number determined by the network every 2,016 blocks. The goal is to keep the mining difficulty so that a block is mined on average every 10 minutes. It is the value targeted by a hashed block header.

Block headers are 80-byte data strings that serve as the ID of individual blocks. They contain information specific to a block, such as its version number, the previous block’s hash, and the timestamp, among other things. Therefore, the mining process consists solely of executing algorithms (the SHA-256 hashing algorithm for bitcoin mining) to hash the block headers to a value below the target. And the first person to accomplish so will receive the block prize, similar to winning the lottery.

In 2009, mining was simple; you could mine with a desktop computer. Intriguingly, as Bitcoin’s popularity increased, its value rose, and more individuals began mining professionally. This raised the difficulty of mining, and you can no longer obtain the block reward with anything less than devices with a high processing capacity.

But even if you don’t want to make a large investment in mining equipment, you still have options. To explain this further, let’s look at the many sorts of mining.

Varieties of Cryptocurrency Mining

You can divide mining into Solo and Pool based on the number of participants. CPU mining and GPU mining refer to the primary equipment used in the process, whilst Cloud Mining refers to the usage of rented infrastructure. Let’s investigate each one separately.

1. Solo Mining

Solo mining, as the name suggests, is mining alone. It is the most expensive method, but you receive the sole return for your work. You also miss out on the earnings of other miners. Mining equipment requires a great deal of electricity. They produce a steady hum of hundreds of chips working to discover the requisite hash faster than any other miner on the earth, both solo and pool.

Creating a cool, well-ventilated, expansive, and distant place in which to install your mining farm will cost you a significant amount of money. Add to this the sky-high cost of mining equipment, and your wallet may already feel lighter.

The good news is that this cutthroat mining environment only applies to bitcoin and a few other established currencies, but you can mine certain other (read: new) crypto coins profitably for a fraction of the outlay.

Solo Mining Profitability

For instance purposes, I will assume that you reside in California, United States. Location is crucial for calculating electricity costs and the overall viability of mining as a profession. You can either purchase a general-purpose crypto mining gear or an Application-Specific Integrated Circuit (ASIC) Miner.

A crypto mining rig is amazing, and it’s comparable to a supercharged personal computer. It utilizes a large number of graphic cards to mine cryptocurrency in the background while you perform other digital tasks. However, it will not be as quick as ASIC units. You should read this post before to assembling your mining equipment.

The next alternative is the ASIC miner, which utilizes specialized equipment created (assembled) specifically for mining. Therefore, I will use the Antminer S19j Pro 100TH/s for this example. It boasts an astounding 100 TH/s hash rate (mining speed) and costs USD 9,300 at the time of publication.

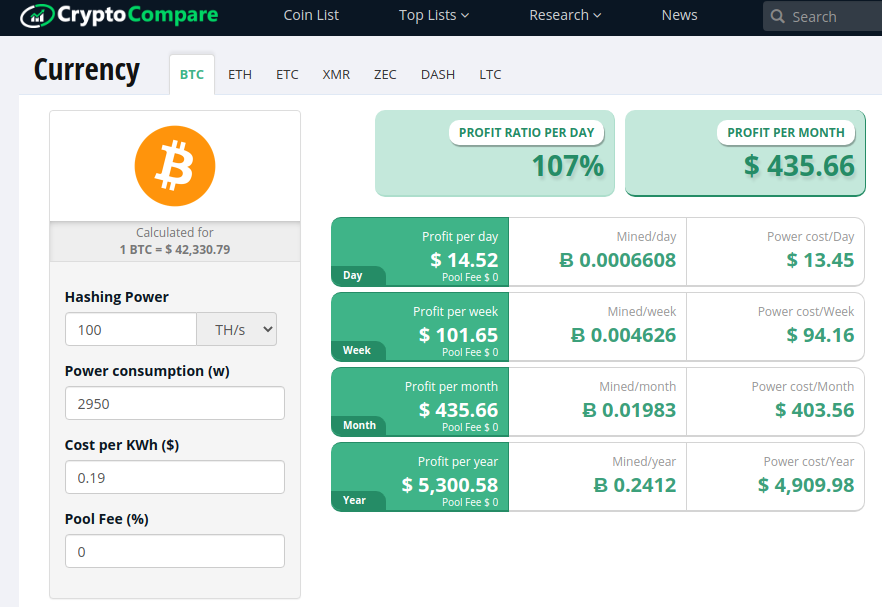

This ASIC miner consumes 2950w of power, and since we’re mining alone, I’ve set the pool fee to zero percent. I’ll use CryptoCompare to compute the profit.

Here is the result:

In 2019, the median income in California was approximately $32,000. According to our estimate, you would need 74 (divide 32,000 by 435, monthly earnings) of these ASICs to reach the average standard of life in California, United States. Keep in mind that we have not yet factored in the cost of real estate, ventilation, and cooling equipment.

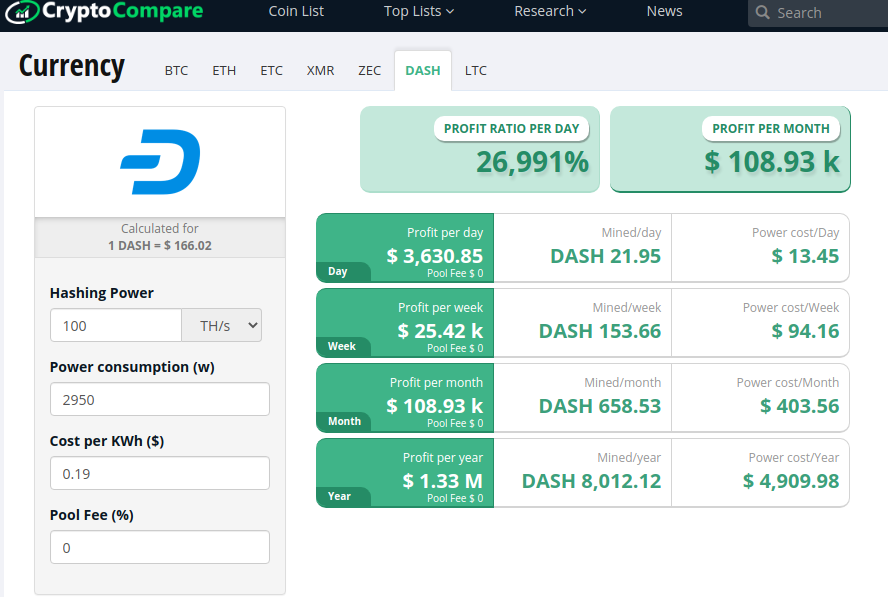

In short, Bitcoin mining is EXTREMELY pricey. This time, let’s perform the calculation for Dash (another cryptocurrency that uses the X11 algorithm).

In this instance, a single ASIC unit drove your monthly profit above USD 100,000. Yes, mining can earn you a millionaire, but only if you mine the proper coin and account for overhead expenses to get a whole financial picture.

In this instance, a single ASIC unit drove your monthly profit above USD 100,000. Yes, mining can earn you a millionaire, but only if you mine the proper coin and account for overhead expenses to get a whole financial picture.

Setup Specific to Solo Mining

These are the duties required to begin solo mining. This is a bit technical, but you’ll get there if you take it step by step.

a) Configure a full node: Full nodes are the key stakeholders in the bitcoin blockchain, as they validate transactions alongside other full nodes.

b) Create a bitcoin.conf file: This file allows you to customize the entire node according to your specifications; save it to the default bitcoin directory.

d) Install any Bitcoin mining program; CGMiner, BFGMiner, MultiMiner, EasyMiner, etc. are available.

d) Launch the mining software according to the information specified in the bitcoin configuration file.

Keep in mind that mining is also dependent on luck. It is not a milestone that can be reached with certainty, even with sophisticated technology. This is especially true for individuals who mine alone. In light of the fact that it is not always possible to invest this much, let’s move on to a more cost-effective option: pool mining.

2. Pool Mining

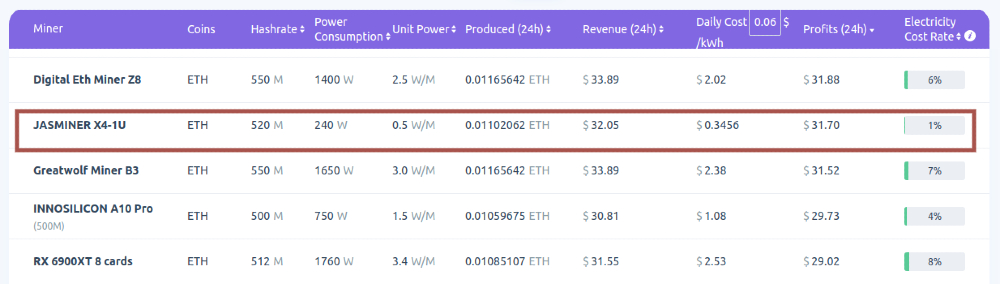

You contribute with your limited computational prowess and receive payments proportional to your hashrate by participating in a mining pool. For instance, you can join F2Pool, the current largest mining pool. Take a look at some of the miner’s profit with their lowest of hashrates at F2Pool:

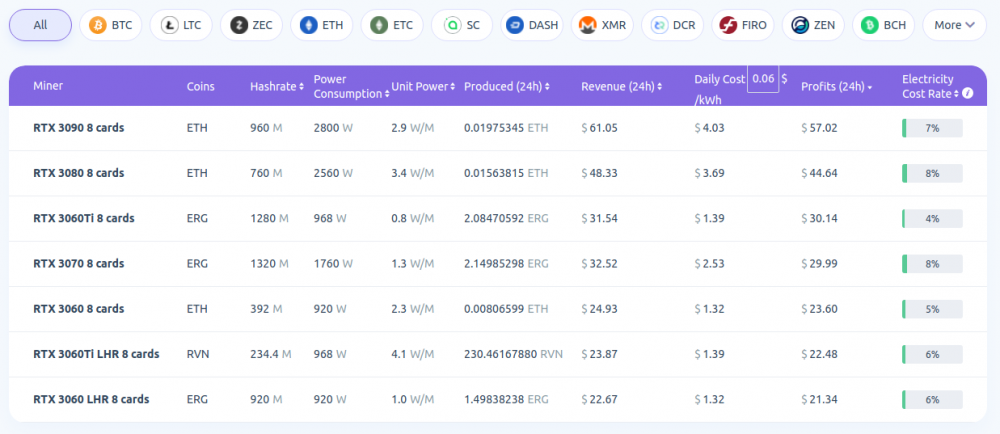

This miner, ‘JASMINER X4-1U,’ with a hash rate of 520 M/s, earns $31.7 a day, yet even he uses an ASIC miner, albeit a less powerful one. Consequently, your income will be lower if you only utilize your graphic card for mining, but you can generate substantial amounts if you employ numerous GPUs like these miners:

Just remember to calculate the electricity cost in your area, as electricity costs alone can exceed your mining revenues and leave you in the red. To begin pool mining, you must first select the pool to join.

Pool charge, reputation, payment cycles, and pool size, among others, are crucial considerations when assessing your selections. It is vital to analyze everything and make the best decision. After choosing a pool, you must visit their website for additional setup steps.

Similar to solo mining, CryptoCompare may also be used for pool mining. The only difference is the pool fees, which vary from 1% to 3% depending on the pool you choose.

3. CPU and GPU Mining

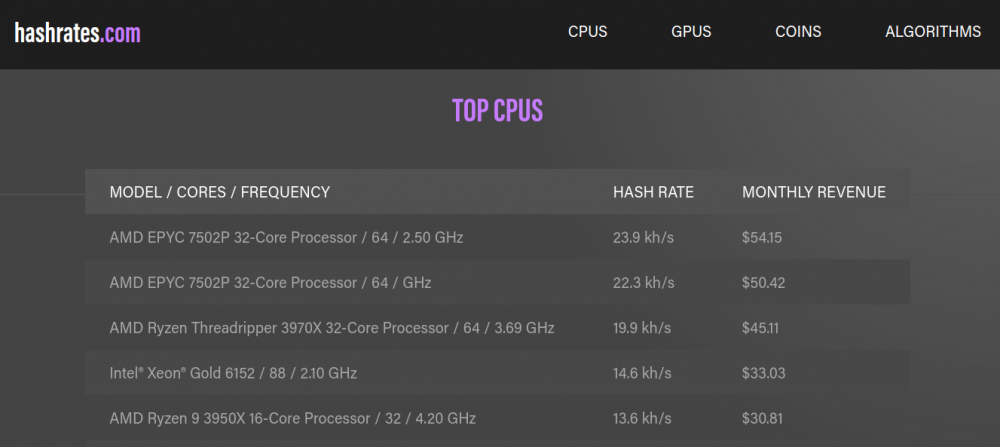

The only distinction is the hardware utilized for cryptocurrency mining. CPUs are less expensive than GPUs, however they do not mine nearly as efficiently.

Therefore, CPU mining is not advised if receiving a block reward is a goal. Currently, having many GPUs in a crypto mining rig is a prerequisite for a lucrative mining operation. However, newcomers to the crypto realm can test it out without making an enormous commitment up front. The configuration is identical for CPU and GPU mining.

Choose and configure a cryptocurrency wallet before downloading and configuring mining software for your selected cryptocurrency.

4. Cloud Mining

With Cloud Mining, you sign a contract with a cloud miner (such as ECOS or Genesis Mining) and they provide you with their mining infrastructure. You pay a recurring charge and mine the cryptocurrency of your choice based on its availability at the cloud miner. It’s similar to using premium Gmail.

Consequently, cloud mining is a straightforward endeavor for wealthy non-technical investors in the bitcoin mining industry. In essence, you invest in fully managed mining operations and profit according on the hashrate purchased with the contract. Notably, you pay your fees in advance even if you don’t earn a profit, because the cryptocurrency market is fickle and your contract doesn’t care.

Bitcoin Trading

In addition to mining, you can also swap fiat currency for cryptocurrencies. To engage in trading, you must register with a crypto exchange and acquire the cryptocurrency of your choosing with your government-issued currency. Some exchange portals also facilitate the exchange of crypto coins.

Mining, however, appeals to crypto fans more than anything else. Not only do they earn bitcoin this way, but they also contribute to the network’s sustainability by making the blockchain more secure and keeping transactions running. Without mining, there will be no new coins, and miners have a say in any network protocol changes.

Closing Statement

Mining cryptocurrencies requires technical expertise. The market is volatile, so it’s best to test the waters properly before investing your hard-earned cash. Try mining little coins before going after the larger ones. And, do not attempt to mine bitcoin (or similar currency) with a single GPU or CPU; doing so would be a waste of time, electricity, and would shorten the lifespan of your equipment.

Before entering the mysterious world of computer currency, it is important to consider all factors, such as land, electricity, atmosphere, hardware, and software. Numerous people are amassing riches through crypto mining, and if you have the necessary expertise and resources, you should be able to do the same.

![How to Buy Land in The Metaverse [2024] + 7 Buying Platforms](https://www.techgiant.net/wp-content/uploads/2022/09/metaverse-324x160.png)